Mobile Banking

Stay In Touch With Your Money

Reliabank’s mobile banking products continue to grow to keep up with your fast paced life. Whether you have an iPhone®, iPad®, or Android® device, we have the mobile banking solution that’s right for you. Download our free app today to take advantage of maximum convenience.

Enroll NowMobile App

Reliabank Mobile Banking is a must-have for those with busy lives on the go. Reliabank’s app is available for iPhone, iPad and Android devices.

- Real-time account transaction information

- Available to our online banking users

- Fast, secure, and easy to use

- Funds transfers

- Check balances

- Receive account alerts

- Pay Bills

- Make deposits

Sign up by downloading our App from your mobile device store, or within Reliabank Online Banking under Preferences.

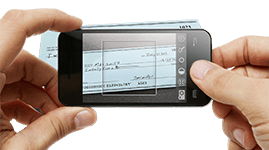

Mobile Deposit

You can utilize our FREE Mobile Deposit service in Mobile Banking simply by choosing the Deposits function through your Smartphone’s banking app.

It’s so easy! All you do is follow the steps, snap a picture, and deposit.

- Select the Deposits button

- Choose the deposit account and enter the check amount

- Take photos of the front and back of the endorsed check

- Verify and Submit the deposit

For your protection, we require writing “Mobile Deposit Only Reliabank” on the back of your check before you deposit it.

Personal Mobile Deposit Use: *Eligibility required: Subject to approval. $1,500.00 check limit per deposit. Maximum of $2,000.00 in total deposits per day.

Business Mobile Deposit Use: *Eligibility required: Subject to approval. $2,500.00 check limit per deposit. Maximum of $5,000.00 in total deposits per day.

We recommend you keep the check for 30 days to confirm the deposit and then destroy it by shredding. Checks can only be deposited once; you will need to come in or send the check if it is rejected. Should your deposit be rejected we will notify you by email. If your mobile deposit is completed prior to 4PM on any business day, you will receive next business day credit on your account for the deposit. Please note all deposits are subject to review and/or final approval by the Bank. To view the new Terms and Conditions open the App on your Mobile Device and tap the “Terms and Conditions” tab. This tab is available on the Log In page of the App as well as under the “More” tab after you’ve logged into the App.

Instant Balance

Access your account balances quickly! The new Mobile Banking Instant Balance feature allows you to access up to 6 of your eligible account balances from the login screen, no password necessary.

You must first opt-in to use Instant Balance; by default, you’re opted-out until activation and set-up are completed. To opt-in and configure your Instant Balance settings, follow these steps:

- Activate the Saved ID feature on the login screen by entering your username and selecting the Saved ID button to the right. This will save your username and pre-fill the field each time you use the app. Once Saved ID is activated, the button label will then read “Change.” Note: If the Saved ID button on the login screen is toggled off at any time, Instant Balance will not function.

- Login to the RELIABANK Mobile Banking app.

- Click on the More tab in the bottom right corner.

- Toggle the Instant Balance feature to the “On” position.

- Once toggled on, the Instant Balance settings will display your list of available accounts viewable before login. You must choose the accounts you would like to see balances for when using this feature; up to 6 balances can be shown per user.

- Checkmarks should display next to the accounts you have selected; select the Save button and you’ll see a confirmation screen.

- The next time you visit the app, you can tap the Instant Balance icon in the top-right corner of the login screen to view the desired balances without logging in.

- At any time, return to the Instant Balance settings from the More tab to reconfigure your settings, or disable the feature completely.

Is it secure? Yes, Instant Balance uses a read-only feature, the same pre-authenticated inquiry used for delivering balances via text message (SMS). It cannot be used to complete transactions and account numbers are always masked. Since no login occurs, no sensitive authentication or account information is transmitted during the interaction.

Data rates may apply. Check with your mobile carrier for details. Apple and the Apple Logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Google Play is a trademark of Google, Inc.

Text Banking

Securely and conveniently access your account from any smart phone browser. App download is not required.

- Log into online banking

- Click Profile in upper right corner

- Mobile Banking – Manage devices

- Click on add a new device and follow the prompts

- After following prompts you will receive a text message with an activation code sent to your phone

- Enter the code and click submit

*Message and data rates may apply.

Questions?

We’re here to help. Find branch hours and locations, or fill out our quick contact form—we’ll get back to you as soon as possible!

Locations & Hours Contact Us