Category: Mortgage

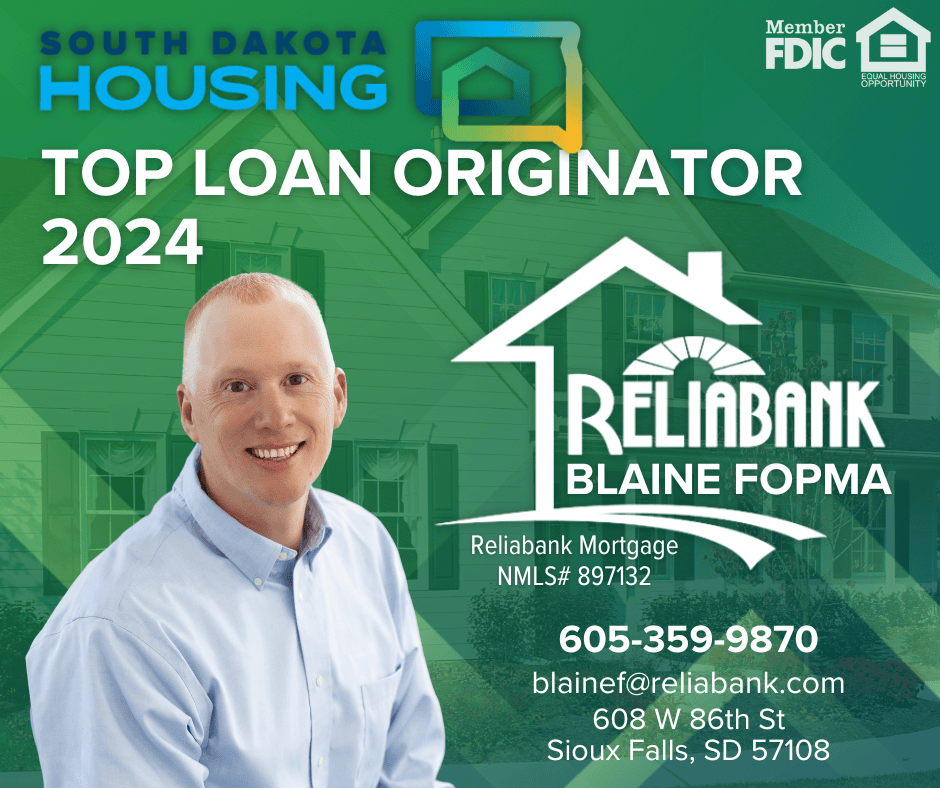

South Dakota Housing Announces Blaine Fopma as Top Loan Originator Recipient

Posted on July 10, 2024 by

Reliabank![]()

Pierre, S.D. (7/9/24) – South Dakota Housing recognized the seven top loan originators of its homeownership loan programs. These programs provide affordable homeownership financing opportunities, which in turn provides security for families, stabilization for communities and the foundation from which dreams are built upon. One of the top South Dakota Housing loan originators of 2024...

Mortgage

Reliabank Mortgage Offers ‘Grants for Grads”

Posted on May 20, 2024 by

Lisa Loomis![]()

South Dakota Housing has launched a program to assist South Dakota college graduates purchase their first home. This new program is open to first-time home buyers who are purchasing a primary residence costing $385,000 or less, and meet income requirements. Applicants must be graduates from an accredited university in the past 60 months. The Grants for...

Mortgage

You Won’t Want To Miss This Construction Loan Offer

Posted on March 20, 2024 by

Reliabank![]()

Are you ready to turn your dream home into a reality? We’re excited to announce that Reliabank Mortgage is now offering an unbeatable opportunity for those looking to build their dream home. Let us help save you more on your new home with our new construction offer! Whether you’re planning to build your first home,...

Mortgage

Win a Dream Vacation!

Posted on March 1, 2023 by

Reliabank![]()

March isn’t just all about basketball. Check out our March MORTGAGE Madness! Get registered to *WIN a DREAM Vacation March 1 – 31st, 2023. It’s a slam dunk! Member FDIC | Equal Housing Lender *Enter to win March 1-31, 2023. To sign up, fill out the form below or stop in at any of our...

Banking Services

Community

Mortgage

5 Important Questions When Choosing Your First Home

Posted on June 11, 2020 by

Reliabank![]()

Moving into your own place can be exciting and frightening at the same time. The American Bankers Association suggests considering the following questions when choosing your own home. How much money do you have saved up? Start with an evaluation of your financial health. Figure out how much money you have for a down payment...

Mortgage